Welcome to India’s most used

Video KYC platform

India’s first Video KYC was done by

Kotak Mahindra Bank on 18th of May 2020

using the VideoCX.io platform.

Our scale and experience in running Video KYC

75+

Financial Institutions using VideoCX.io for VKYC

3M+

Monthly Video calls processed

100 mil

Total VKYCs completed since inception

21

Banking products covered

44

Different product journeys with AI enabled features

One platform to manage your complete Video Banking journey

Integrate with your journeys

APIs for straight through journey or create an independent journey and page

Customer routing logic

Route customers to employee pool basis product, language, history, purpose

Customer queue management

Configurable wait time logic, token system, instructions, prioritization

Video call with customer

All video calling features like recording, screen sharing, chat, file sharing

Additional features and workflows

Add and customize steps like face match, QnA, doc capture, ID verification

Checker module for audit

Auditors can play video recordings, check documents and approve transactions

APIs to sync data with other systems

APIs to sync all the meta data, video recordings, docs, dispositions etc

Live dashboard and reports

Monitor live customer traffic, employee productivity, call results etc

Three ways to do Video KYC

Straight through Journey

Customer can complete the Video KYC immediately after filling the account opening form.

Independent Weblink

Customer can access a link on the RE’s website, do eKYC and then move to VKYC.

RM / Agent Assisted

Agent can assist a customer to fill a form online and get connected directly.

All US regulatory compliant mandated features

- White labelled platform

- Hosted on RE domain

- Customer consent stored

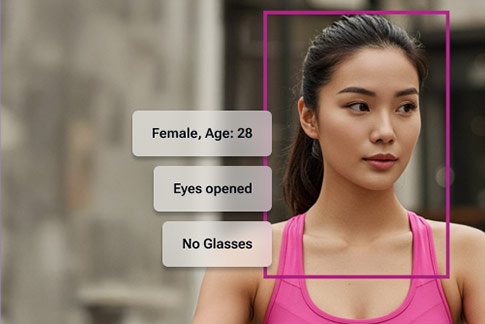

- Random verifications questions and liveness check

- Social profile question

- User photo capture and face match

- SSN validation and eSSN option

- US location and IP address check

- Auditor module for checker role

- End to end encryption

- Video recording with Lat Long and time stamp

- Integrated with SSN/IRS databases, Passport, Driver’s License, and state-level document vaults

All the possible eKYC options on or before the call

- RE’s SSN validation & IRS API check

- Passport OCR upload

- Driver’s License OCR and validation

Pre-call connection features

- SSN validation & IRS API check

- Passport OCR upload

- Driver’s License OCR and validation

Integrated with Google Maps for location feature

- Location keyword check for restricted US regions (e.g., OFAC-listed)

- Political country check for USA

- Distance check between SSN-registered address and live address

Verification questions module

- Option to ask up to 15 questions to customer

- Option to mark it as Match / Mismatch

- Option to mark it as Responded / Not Responded

- Randomize questions from list of question from API

- Randomize order in which they are shown

- Option to have fixed questions and random questions

In built Auditor / Checker module

- Option to Approve, Reject and Re-open cases

- Configurable bucket allocation and auto refresh

- Additional checkboxes for each audit point

- Fastrack cases into Auditor bucket

- Auto clear auditor bucket

- Option to reassign cases to other Auditors

Multiple Video KYC Dashboards to track every step

Per day summary from customer entry to Success

Product, Team or Group wise dashboard

Real time Agent monitoring dashboard

Real time customer queue

Auditor performance dashboard

Agent and auditor times sheet report

Customized excel reports for download